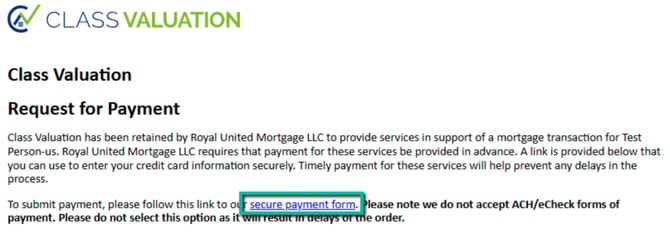

How can borrowers use Affirm to "pay later?"

Class Valuation Pay Later Solution - PDF

-

What is our "Pay Later Solution" for End-Borrowers?

- What is "Pay Later?"

The End Borrower:

-

- Chooses a payment plan option to make installment payments.

- Gets informed the exact total amount they will pay right up-front, and they agree to pay those amounts.

- Then gets reminders by email and text from our partner Affirm until they settle the balance with Affirm

- Knows what they owe and when they will be done paying off their purchase.

-

The Three (3) Payment Options We Now Offer

- Pay in four (4) installments of two (2) weeks each

- Customers must qualify based on their soft credit score.

- They pay 25% of the cost up-front and then three (3) subsequent payments with no interest.

- Three-month option - pay monthly over three (3) months, with interest.

- Six-month option - pay monthly over six (6) months, with interest.

- Pay in four (4) installments of two (2) weeks each

Notes

1. We limit our options to six months or less to avoid affecting debt-to-income ratios needed for loan eligibility.

2. Applicable interest rates are 0% - 36% APR, and a down payment may be required depending on credit-worthiness.

-

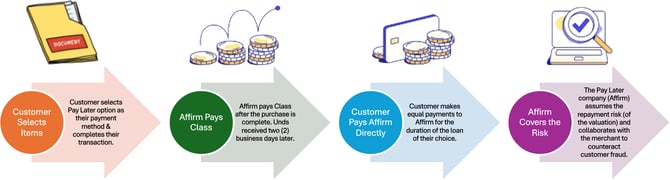

How it works for End-Borrowers & Class Valuation

- End-Borrowers

- Allows borrowers to pay appraisal fees over time, helping to cover closing costs (Class differentiator)

- No hidden fees: No late fees, no prepayment fees, no penalties, or setup fees

- No impact on a consumer's credit score when they apply - Affirm only pulls a "soft credit check" including their name, email address, phone number, birthday and last four digits of SS# to apply.

- Instant loan decision

- If the loan becomes delinquent (the end-borrower does not pay Affirm), their credit score may be impacted.

- Class Valuation

- Fees: Class fees are 5.6% per order ($25/order average)

- Refunds: If refund is matched to loan transaction, the refund will be applied towards that loan balance, starting with last payment first. If they are unable to match the refund to an existing payment plan, consumer may receive a refund check in the mail.

- Customer Questions: Class does not deal with consumer on the Pay Later process. This is strictly between the consumer and Pay Later vendor (Affirm).

- Payments: Class is paid full amount of loan purchase within two business days.

- Bad Debts: Class is not responsible if consumer does not pay. This relationship is strictly between consumer and Pay Later vendor.

- End-Borrowers

-

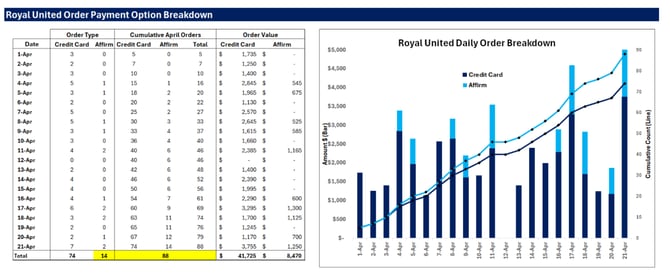

Pilot Customer Update (Royal United)

- We won back Royal United's business because of this offer

- Since the April 1, 2025 launch, 16% of borrowers have chosen a Pay Later solution

-

Next Steps to Market the Solution and Win More Orders

- Ensure Royal United Pilot gives Class the 300/month order allocation they committed – Matt Albino

- Continue reporting Pay Later usage for Sales & Marketing teams – Chrissy Boblits

- Develop Marketing Program for the “Class Pay Later solution” – Holly Shipley

- Sales team to verbally advise customers of this offering & benefits - Jon Willen

Note

We can explored more payment options in the future, but we are starting simple.